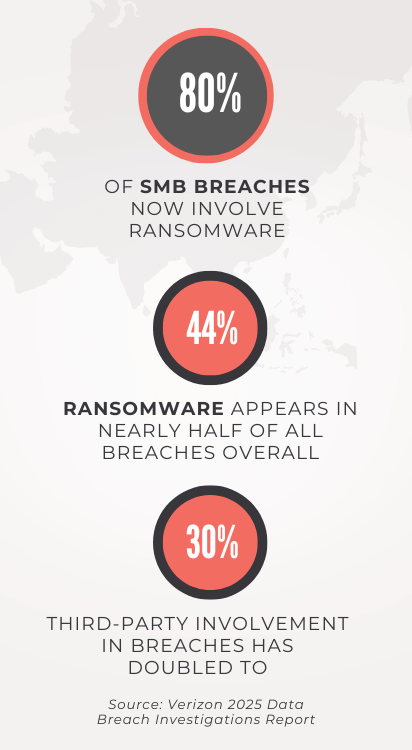

According to the 2025 Verizon Data Breach Investigations Report, ransomware now appears in 88% of breaches impacting small and mid‑sized businesses — making SMBs one of the hardest‑hit groups in today’s threat landscape. On top of that, IBM’s 2024 Cost of a Data Breach Report indicates that the average cost of a breach for small and mid-sized businesses has skyrocketed to over $3 million, taking into account downtime, recovery efforts, legal expenses, and lost revenue.

The U.S. National Cybersecurity Alliance reports that 60% of small businesses shut down within six months after a major cyberattack. This isn’t a rare occurrence; it’s happening every day, often targeting the businesses that are the least prepared to face such challenges.

Cybersecurity has evolved beyond just a technical issue; it’s now an essential part of operating a modern business. The digital tools that support small business growth are the same ones that attackers are looking to exploit. Today, small businesses depend on cloud platforms, online payment systems, digital scheduling, remote work, and customer data management. This heavy reliance on digital solutions means that just one breach can disrupt everything from sales and communication to payroll and scheduling, impacting the business overall operations.

According to the FBI’s 2023 Internet Crime Report, there were over 800,000 complaints about cybercrime, resulting in losses that topped $12.5 billion — the highest amount ever recorded. Attackers are now employing AI-generated phishing emails, automated tools for cracking passwords, and ransomware kits that anyone can use without needing any technical skills.

Why Cybercriminals See Small Businesses as Easy Wins

Demand for cyber insurance is increasing, with carriers requiring businesses to implement multi-factor authentication, endpoint protection, regular backups, and employee training. Failure to meet these requirements may result in lack of coverage or payouts following incidents, emphasizing the necessity of robust cybersecurity for protecting businesses and customers.

Here’s why they become prime targets for attackers:

Weaker Security Lead to Simple Breaches

Every business has its own unique needs. We tailor our workshops and resources to align with your workflow, whether it’s file management, using cloud applications, or ensuring data security.

Lack of Employee Training to Spot Threats

The Cyber Readiness Institute found that only 17% of small businesses actually provide ongoing cybersecurity training. This is a big deal because it only takes one employee to accidentally click on a fake invoice or a phishing login page to put the whole business at risk.

Small Businesses Hold Valuable Data

Small companies have a lot of valuable data, including:

- Customer information

- Payment details

- Employee records

- Vendor accounts

The “We’re Too Small to Be Targeted” Mindset

This illusion of safety is exactly what attackers rely on. According to the Verizon DBIR, small businesses are often targeted because they fail to recognize their own risk.

Small Businesses Face a Greater Chance of Having to Pay Ransoms

Small businesses often lack adequate backups or recovery plans. When ransomware hits, many feel they have no other choice but to pay the ransom. Hackers are fully aware of this and use it to their benefit.

One Breach Can Shut Down Business Operations

Small businesses, unlike big corporations, usually don’t have crisis funds or dedicated backup teams. Just one breach can stop operations, drain finances and severely damage customer trust.

In short, small businesses are a prime target for cybercriminals, combining valuable data with insufficient security defenses.

The Real Cost of a Cyberattack

Operational Shutdown

When your systems go down, your business takes a hit. Point-of-sale systems can lock up, emails might stop working, websites could crash, and employees may struggle to access essential tools. For many small businesses, even a short 24 to 48 hours of downtime can result in significant revenue loss—often amounting to thousands of dollars.

Recover is Not Cheap

When you think about restoring systems, bringing in IT experts, rebuilding servers, and getting your data back, the costs can quickly add up—often more than what small businesses expect. IBM’s 2024 report reveals that breach recovery expenses have increased by 15% over the last three years.

Legal and Compliance Risks

Depending on the type of data that’s exposed, businesses can encounter a range of legal and compliance risks, including:

- Required breach notifications

- Financial penalties

- Lawsuits that could be costly

- Investigations that can take a toll on their resources

Customer Trust Takes a Hit

Customers may let a mistake slide, but they hardly ever forget a breach of trust. When that trust is lost, it can be really hard to regain. Many businesses experience a significant decline in sales for a long time after a cyber incident.

If You’re Ready to Protect Your Business, We Can Help

Send us an email at info@techassured.com or give us a call on (310) 861-3633.

Weaker Security Lead to Simple Breaches

Every business has its own unique needs. We tailor our workshops and resources to align with your workflow, whether it’s file management, using cloud applications, or ensuring data security.